Fascination About Feie Calculator

Table of ContentsTop Guidelines Of Feie Calculator5 Simple Techniques For Feie CalculatorFeie Calculator for DummiesWhat Does Feie Calculator Do?Facts About Feie Calculator Uncovered

He offered his United state home to establish his intent to live abroad completely and used for a Mexican residency visa with his better half to assist meet the Bona Fide Residency Test. Neil points out that getting residential property abroad can be testing without initial experiencing the location."It's something that people need to be truly diligent regarding," he says, and advises deportees to be cautious of common mistakes, such as overstaying in the United state

Neil is careful to mindful to Tension tax authorities that "I'm not conducting any carrying out any type of Service. The U.S. is one of the couple of countries that tax obligations its people no matter of where they live, meaning that also if a deportee has no income from United state

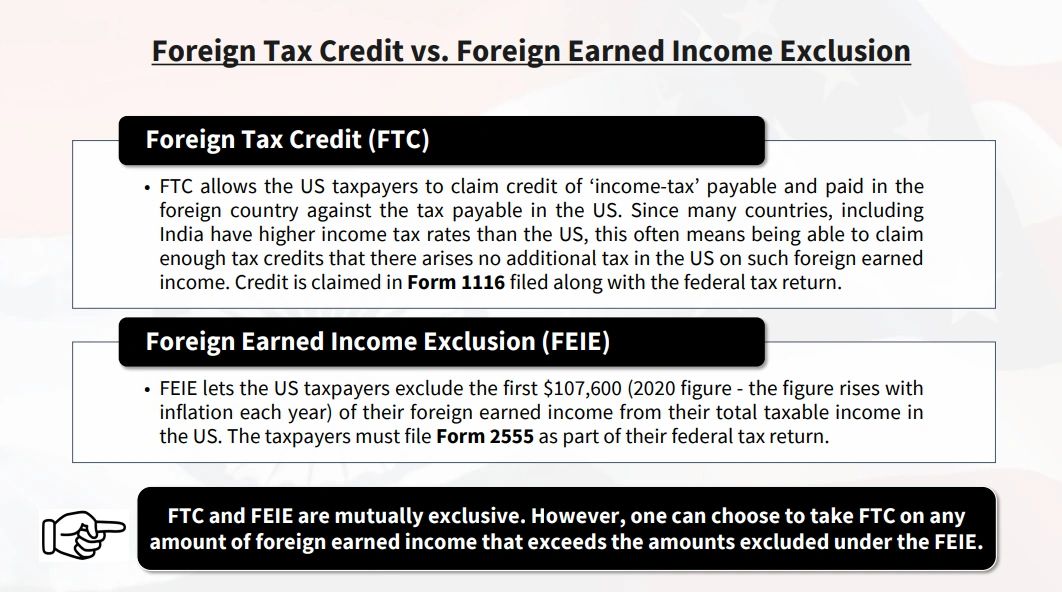

tax return. "The Foreign Tax obligation Credit report allows individuals working in high-tax countries like the UK to offset their United state tax obligation liability by the amount they have actually already paid in tax obligations abroad," states Lewis.

Feie Calculator for Beginners

Below are a few of one of the most regularly asked inquiries about the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) permits U.S. taxpayers to exclude approximately $130,000 of foreign-earned income from federal earnings tax, minimizing their united state tax obligation liability. To receive FEIE, you need to fulfill either the Physical Existence Test (330 days abroad) or the Authentic Residence Examination (confirm your main home in a foreign nation for a whole tax year).

The Physical Presence Examination likewise calls for United state taxpayers to have both an international earnings and a foreign tax obligation home.

Feie Calculator - The Facts

A revenue tax treaty between the united state and one more nation can help prevent double taxation. While the Foreign Earned Earnings Exclusion reduces gross income, a treaty might give fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declaring for united state citizens with over $10,000 in international financial accounts.

Qualification for FEIE depends on conference certain residency or physical visibility tests. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxes, cannabis taxes and divorce related tax/financial preparation matters. He is a deportee based in Mexico.

The international made earnings exclusions, occasionally referred to as the Sec. 911 exclusions, leave out tax on incomes made from functioning abroad.

The Best Guide To Feie Calculator

The income exemption is currently indexed for inflation. The optimal yearly earnings exemption is $130,000 for 2025. The tax obligation advantage leaves out the earnings from tax obligation at bottom tax obligation rates. Previously, the exclusions "came off the top" lowering income topic to tax at the top tax obligation prices. The exemptions may or may not decrease income utilized for various other purposes, such as IRA restrictions, child debts, individual exemptions, and so on.

These exemptions do not exempt the wages from United States tax yet just give a tax decrease. Keep in read the article mind that a solitary person working abroad for all of 2025 who earned concerning $145,000 without various other income will have gross income decreased to absolutely no - successfully the same answer as being "free of tax." The exemptions are computed on a day-to-day basis.

Comments on “10 Easy Facts About Feie Calculator Shown”